Credit Score vs. Credit Report: Have you ever wondered why lenders approve or deny credit applications? Two key tools drive their decision: credit scores and credit reports. While they’re related, they serve very different purposes.

Let me, Manish Kachariya, a Chartered Accountant with years of financial expertise, make it easy for you.

By the end of this article, you will not only understand the difference but also learn how to use both to boost your Credit Score.

Let’s Check the Key Differences between Credit Scores vs. Credit Reports.

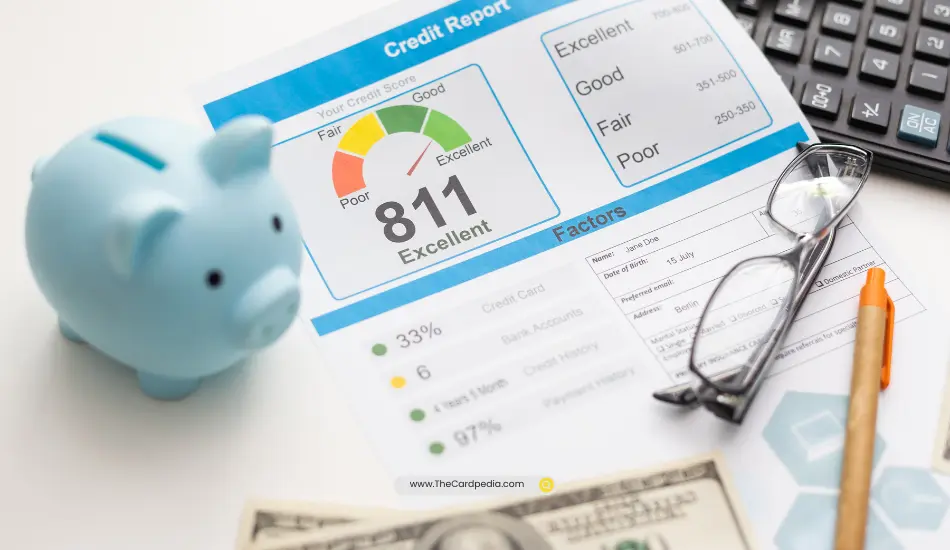

What is a Credit Score?

Your credit score is divided by your financial GPA. This is a three-digit number that summarizes your creditworthiness. Lenders rely on it to keep track of how much you pay back what you borrowed.

Why It Matters

- It’s the first thing lenders check when you apply for credit cards, mortgages, or even apartment rentals.

- A High Credit Score means better interest rates and loan approvals.

Key Factors Affecting Your Credit Score

- Payment History – Paying on time is crucial. Late payments can hurt your score.

- Credit Utilization Ratio – Keep your balances low compared to your credit limits. Aim for under 30%.

- Length of Credit History – The longer, the better. Start building credit early.

- Credit Mix – A healthy mix of loans and credit cards shows you can handle various credit types.

- Recent Credit Applications – Too many hard inquiries in a short time can lower your score.

| Credit Score Range | Rating | What It Means |

|---|---|---|

| 300–579 | Poor | Limited options for credit |

| 580–669 | Fair | May qualify, but at higher rates |

| 670–739 | Good | Eligible for better offers |

| 740–799 | Very Good | Enjoy competitive rates |

| 800–850 | Excellent | Access to top financial products |

What is a Credit Report?

Now think of your credit report as your financial record. It is a detailed account of your credit activity over the years.

This includes all credit cards, loans and even negative signals such as late payments or bankruptcy.

The three major credit bureaus—Equifax, Experian, and TransUnion—compile these reports.

What’s Inside Your Credit Report?

- Personal Information – Your name, Social Security number, and address history.

- Credit Accounts – Details of all your credit cards, loans, and their payment history.

- Public Records – Bankruptcies or court judgments.

- Credit Inquiries – Lists who checked your credit and why.

Credit Score vs. Credit Report: Must-Know Facts for Every American

| Feature | Credit Score | Credit Report |

|---|---|---|

| Definition | A number representing creditworthiness | A detailed record of your credit history |

| Purpose | Quick snapshot for lenders | Comprehensive analysis for decisions |

| Updated Frequency | Frequently | Periodically |

| Access | Obtainable through apps or services | Free annually from credit bureaus |

To better understand how financial tools impact your credit, check out our blog on Debit Card vs. Credit Card: What’s the Difference? and see how they influence your credit report and score.

The Connection Between Credit Score and Credit Report

Here’s the catch,

Your credit score is calculated using the information in your credit report. Errors or negative marks on your report card directly affect your score.

For example:

- A late payment recorded in your report can drop your score by several points.

- Correcting an error, like a wrongly reported delinquency, can improve your score almost instantly.

Why Should You Care of Your Score?

- For Loans and Credit Cards

Your score determines not just approval but also the interest rate. A better score means saving thousands on loans. - For Renting and Jobs

Many landlords and employers check credit reports. A clean report can give you an edge.

Practical Tips to Maintain a Healthy Credit Profile

- Check Your Credit Reports Regularly

Mistakes happen. Review your reports from all three bureaus at least once a year at AnnualCreditReport.com. - Dispute Errors Immediately

Found a mistake? Dispute it online for a quicker resolution. - Build Credit Wisely

- Pay bills on time.

- Keep balances low.

- Avoid unnecessary credit applications.

- Monitor Your Credit Score

Use free tools like Credit Karma or your bank’s credit monitoring feature.

Pro Tip: Weigh Yourself with the Same Scale

When checking your Free credit score, stick to the same version (e.g., FICO or VantageScore) to avoid confusion caused by slight differences in calculation methods.

Bottom Line

Your credit score and credit report are two sides of the same coin.

While your credit score gives a snapshot of your financial health, your credit report provides the full picture. Master both, and you’ll unlock better economic opportunities.

Don’t let your credit define you—take charge of it.

At TheCardPedia.com, we’re your trusted partner in mastering the world of credit cards. Discover expert insights, the latest trends, and practical tips to make smarter financial decisions.

[…] Timely payments are crucial to building a positive credit history. The Chase Freedom Rise Credit Card reports to all three major credit bureaus, ensuring that your good payment habits are reflected in your credit report. […]

[…] card companies usually decide your credit limit after you apply for a card. They look at your credit report, history, and the income details you […]