Get Your Free Credit Report & FICO Score : Worried about your credit report? Want to check your free credit report and FICO Score? You’re in the right place! This post will share details about the Experian App, where you can get your free credit report and FICO Score. Learn more and check your credit score today!

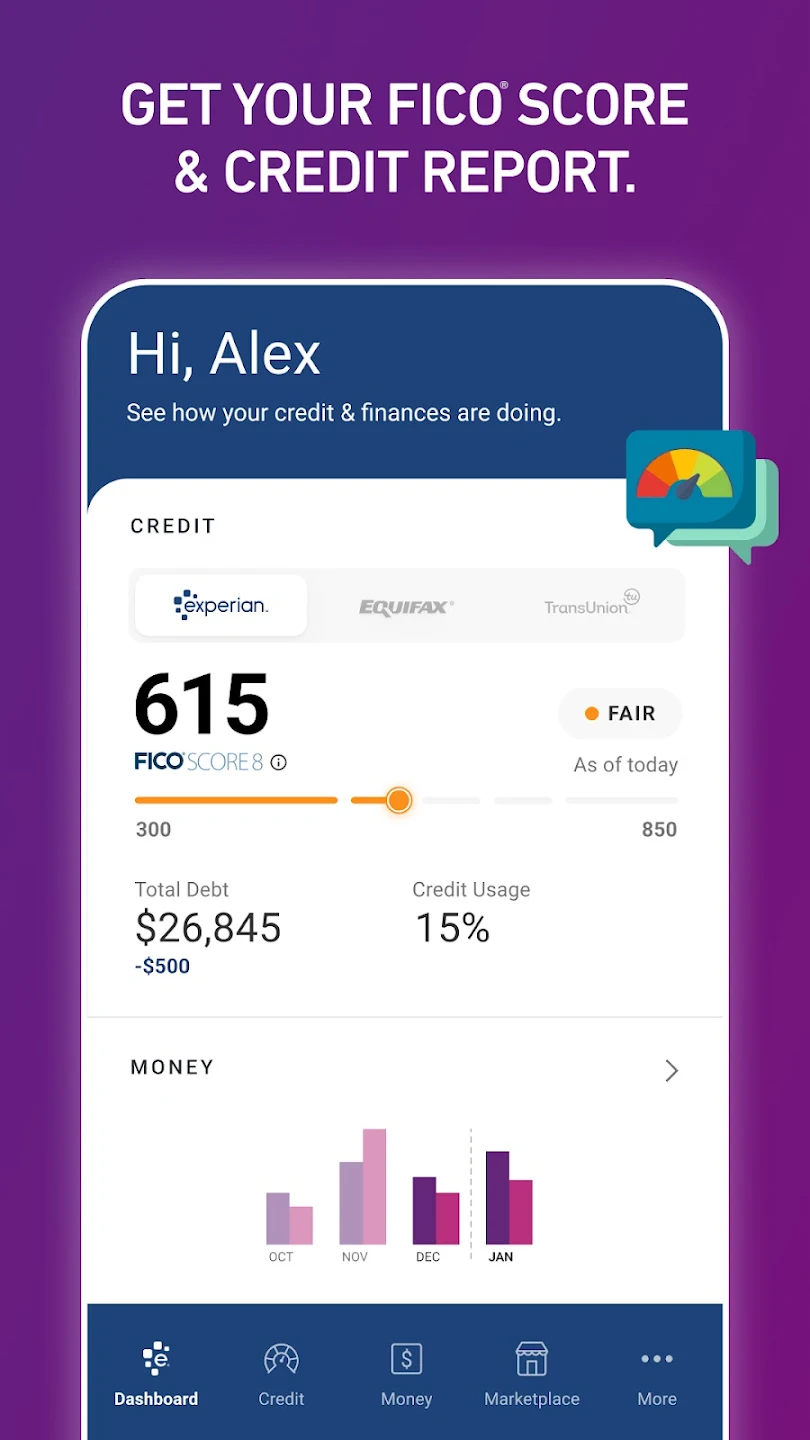

The Experian app is a one-stop shop for managing your credit health. It allows you to check your free credit report and FICO score, which is a key factor in determining your creditworthiness and the interest rates you qualify for on loans and mortgages.

Regularly monitoring your credit report helps you identify any errors that could be bringing your score down and take steps to correct them.

The Experian app also provides credit monitoring features that can alert you to any changes to your credit report, such as new accounts being opened in your name or changes in your credit utilization ratio. This can help you identify potential fraud early on and take steps to protect yourself.

Why Choose the Experian App?

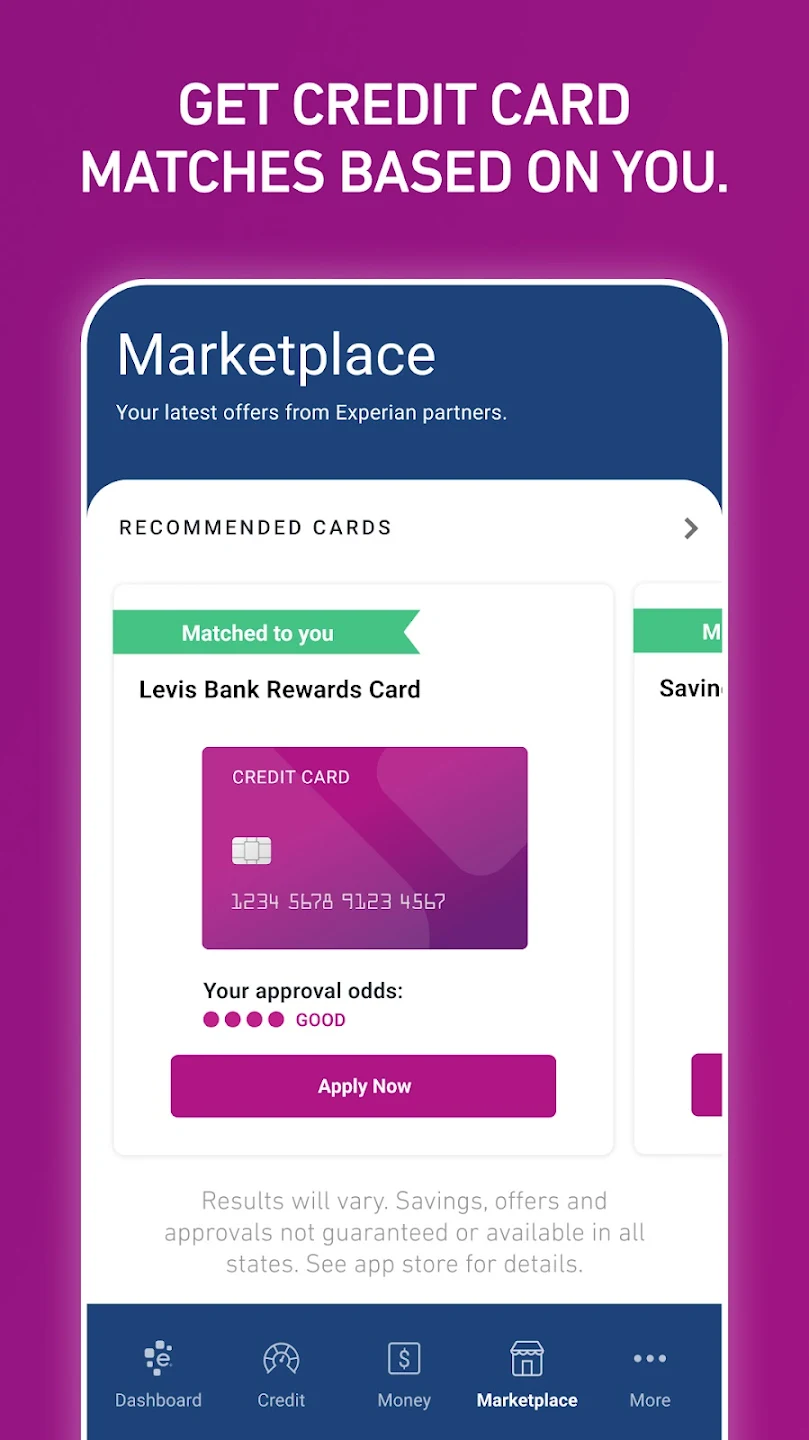

- Free Credit Report & FICO® Score: Unlike some credit monitoring services, Experian offers your essential credit information at no cost. You can check your Experian credit report and FICO® Score regularly to stay informed about your financial health.

- Credit Monitoring & Alerts: Stay on top of your credit with timely notifications for any changes to your credit report, such as new accounts, inquiries, or potential errors. Early detection allows you to address any issues promptly.

- Actionable Insights: Gain valuable insights into the factors impacting your FICO® Score. The Experian app breaks down the components that influence your score, helping you identify areas for improvement.

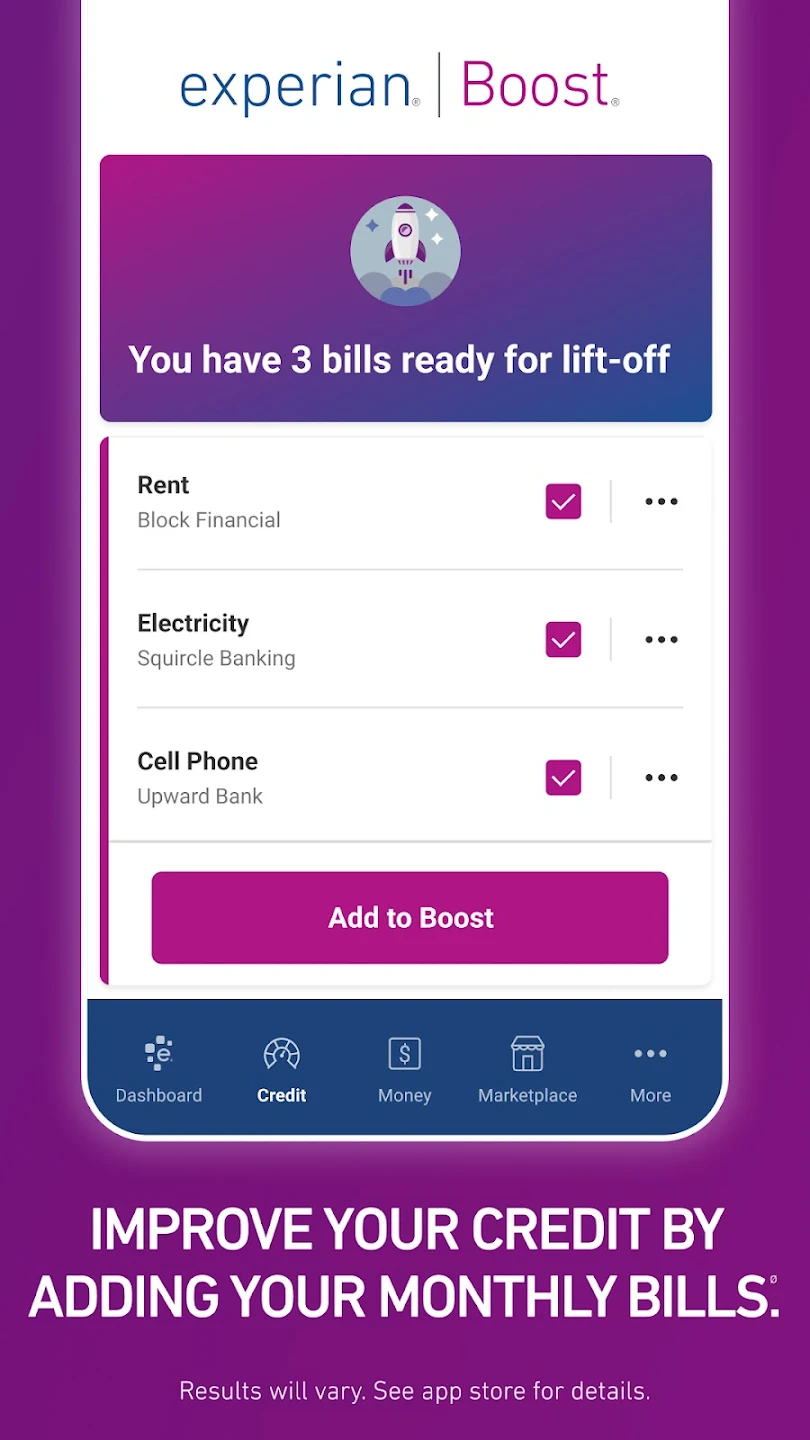

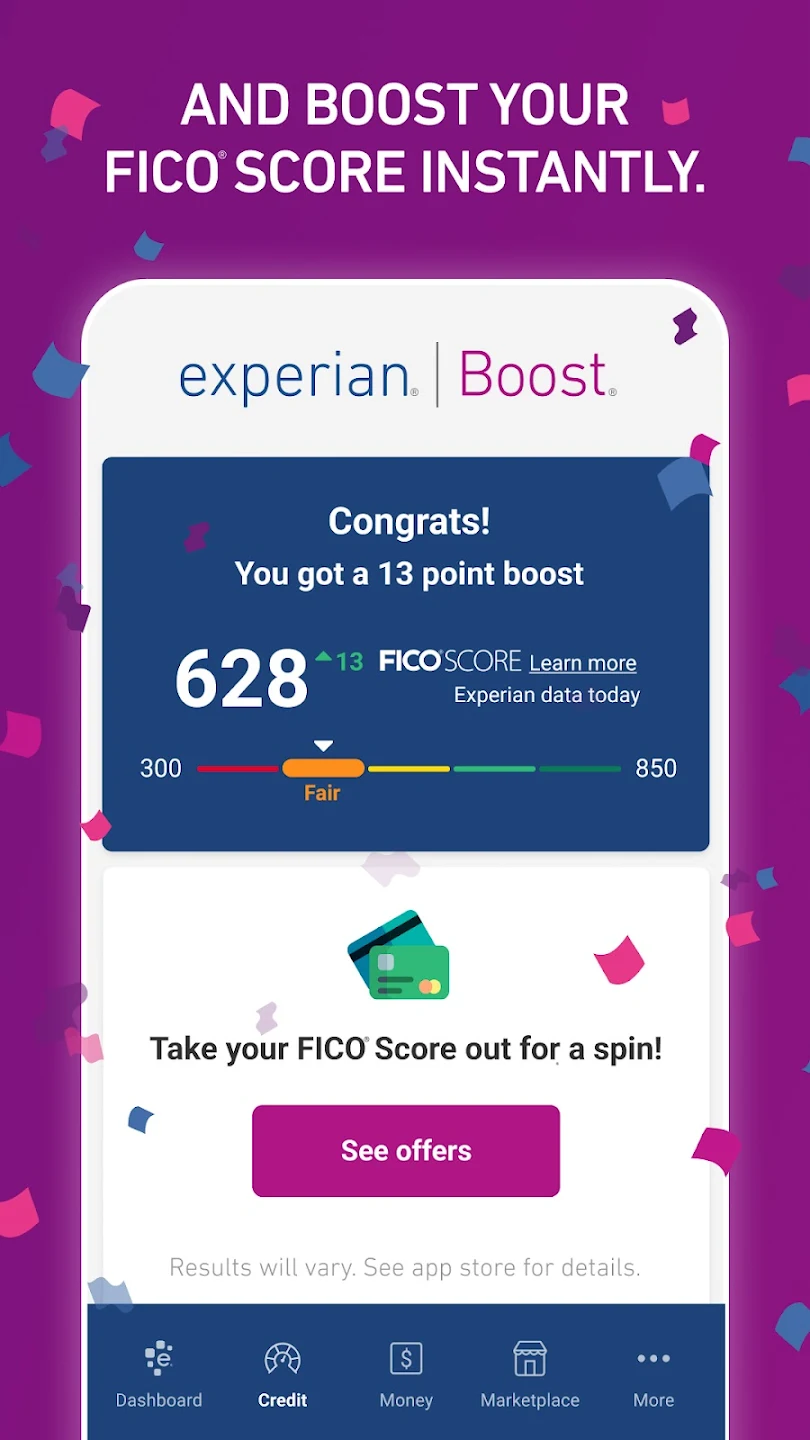

- Experian Boost®: Take advantage of Experian Boost®, a free feature that allows you to add utility, phone bill, and streaming service payments to your credit report, potentially increasing your FICO® Score.

Benefits of Using the Experian App

- Convenience: Access your credit information anytime, anywhere, right from your smartphone.

- Peace of Mind: Stay on top of your credit health and identify potential errors or fraudulent activity quickly.

- Improved Financial Decisions: By understanding your credit score, you can make informed decisions about loans, credit cards, and other financial products.

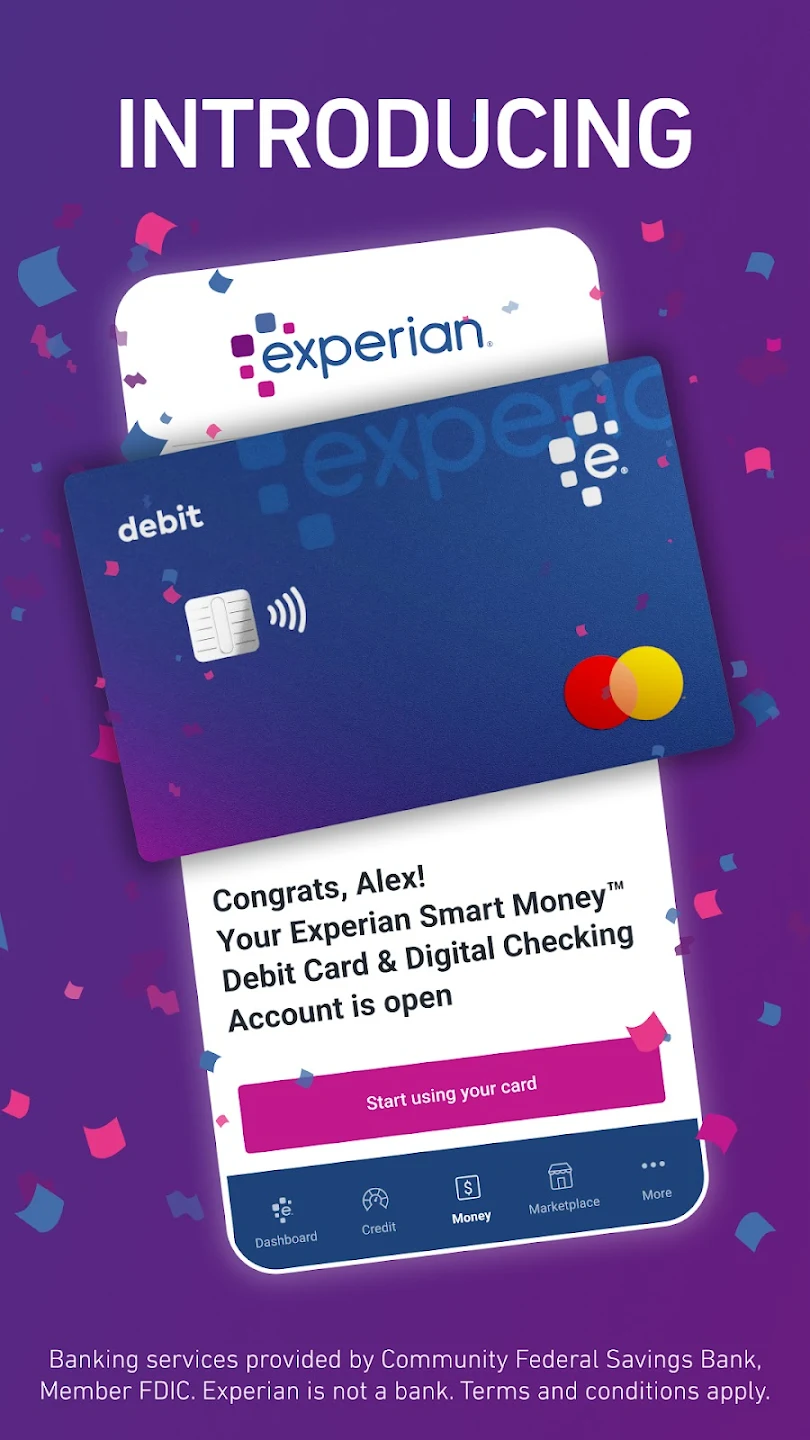

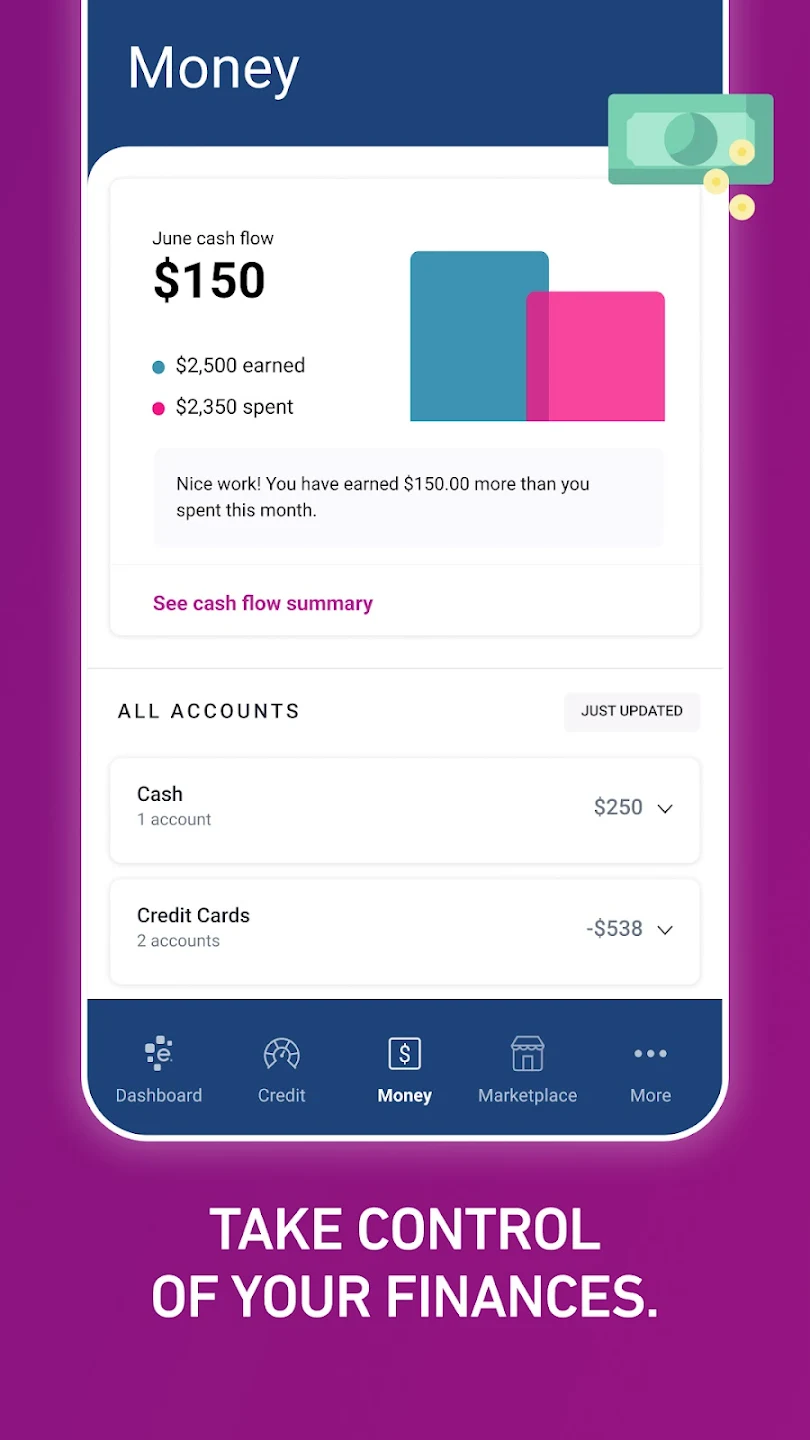

Beyond Credit Reports: A Financial Management Powerhouse

The Experian app goes beyond just credit reports. Here are some additional features to leverage:

- Credit Simulator: Explore how potential financial decisions, like taking out a loan, might affect your FICO® Score. This empowers you to make informed choices.

- Educational Resources: Learn valuable tips and information about credit health, budgeting, and responsible debt management.

- ID Theft Protection: Upgrade your Experian membership for additional security features like ID theft protection and fraud alerts.

User-Friendly Design & Secure Access

The Experian app boasts a user-friendly interface, making it easy to navigate and understand your credit information. Plus, Experian prioritizes security, safeguarding your sensitive financial data with robust encryption protocols.

Experian App: Get Your Free Credit Report Today!

Overall, the Experian app is a useful tool for monitoring your credit health. Downloading and using the Experian app is simple and free. Just search for “Experian” in your app store, download the app, and create an account.

- Apple App Store: https://apps.apple.com/us/app/experian-the-credit-experts/id1087101090?platform=ipad

- Google Play Store: https://play.google.com/store/apps/details?id=com.experian.android&pcampaignid=web_share

Tips to Boost Credit Score

If you are new user of credit card and your credit limit are low at initial stage. don’t worry!. there are number of way to boost Credit Score.

- Regularly monitoring your credit report is essential for identifying and rectifying errors.

- The Experian app empowers you to make informed financial decisions with valuable insights and educational resources.

- Consider the optional features like Experian Boost® and ID Theft Protection for a more comprehensive financial safety net.

📌📢 Read More : https://thecardpedia.com/9-ways-to-boost-your-credit-score-fast/

Additional Tips for Maintaining a Healthy Credit Score

- Make timely payments on all your bills.

- Keep your credit card balances low.

- Avoid opening too many new credit accounts at once.

- Review your credit report regularly for errors and dispute them if necessary.

By downloading’s the Experian app and following these tips, you can take control of your credit health and unlock a brighter financial future.

It’s important to obtain your free credit report from all three major credit bureaus (Experian, Equifax, and TransUnion) annually. You can do this at https://www.annualcreditreport.com/index.action.

Experian App FAQs

Yes, the Experian App is free to download and use. You can access your free Experian credit report and FICO® Score at no cost. However, some advanced features like ID Theft Protection require a paid membership.

The Experian App displays your Experian credit report, which is one of the three major credit bureaus in the United States. It’s important to monitor all three bureaus for a complete picture of your credit health.

Free credit report updates on the Experian App typically occur weekly, but may vary.

Credit alerts notify you of any changes to your Experian credit report, such as new accounts, inquiries, or potential errors. This allows you to identify and address any suspicious activity promptly.

Experian Boost® is an optional feature that allows you to add utility bill, phone bill, and certain streaming service payments to your Experian credit report. This may potentially increase your FICO® Score, but not all lenders use FICO® Scores impacted by Experian Boost®.

Your FICO® Score is a three-digit number that summarizes your creditworthiness based on your credit history. It plays a significant role in determining loan approvals, interest rates, and other financial products.

The Experian app itself doesn’t offer credit repair services. However, it empowers you to monitor your credit report and dispute errors, which is a crucial step in improving your credit score.

🔍 Read More:

- Credit Karma: Free Credit Score & Reports access in 2024

- What is APR: Your Guide to Choosing the Right Credit Card

- Credit Card Limit Mystery: Why Did You Get a Low Limit?

At TheCardPedia.com, we’re your trusted guide to mastering credit cards. Explore expert insights, trends, and tips to make savvy financial choices. Start your journey to financial empowerment now!

[…] The study simulated the impact of adding BNPL accounts to consumer credit reports and examined how it influenced FICO scores. […]